CapitalUK Tax:

Quality accounting services for economically conscious businesses.

- Bank Account

- Bookkeeping

- Business Insurance

- Business Plan

- Business Start Up

- Business Valuations

- Capital Gains Tax

- Company Formation

- Confirmation Statement

- IR35 Review

- Inheritance Tax Planning

- Management Accounts

- Payroll/Auto Enrolment

- R & D Tax Credit

- Registered Office

- Seed Enterprise Investment (SEIS/EIS)

- Self-Assessment

- Strategic Marketing

- Tax Disputes

- Tax Investigation Protection

- Tax Planning

- Trusts

- VAT Returns

- Year End Accounts

Bank Account

Bank Account Setting up a business bank account and putting in place the right levels

Bookkeeping

Bookkeeping Some business owners think that doing everything on their own can save money. However,

Business Insurance

Business Insurance Businesses need business insurance because it helps cover the costs associated with property

Business Plan

Business Plan Starting a business can be overwhelming but creating a business plan can help

Business Start Up

Business Start Up Deciding to open a new business is step one on the road

Business Valuations

Business Valuations Business valuation is not about just numbers, but its importance lies in understanding

Capital Gains Tax

Capital Gains Tax Individuals are charged Capital Gains Tax or CGT, a tax charge applied

Company Formation

Company Formation Knowing what business structure to use when you set up a business can

Confirmation Statement

Confirmation Statement All limited companies and limited liability partnerships must file a confirmation statement at

Inheritance Tax Planning

Inheritance Tax Planning When you have worked hard all your life to create a future

IR35 Review

IR35 Review An IR35 review should be something you do before you start a contract

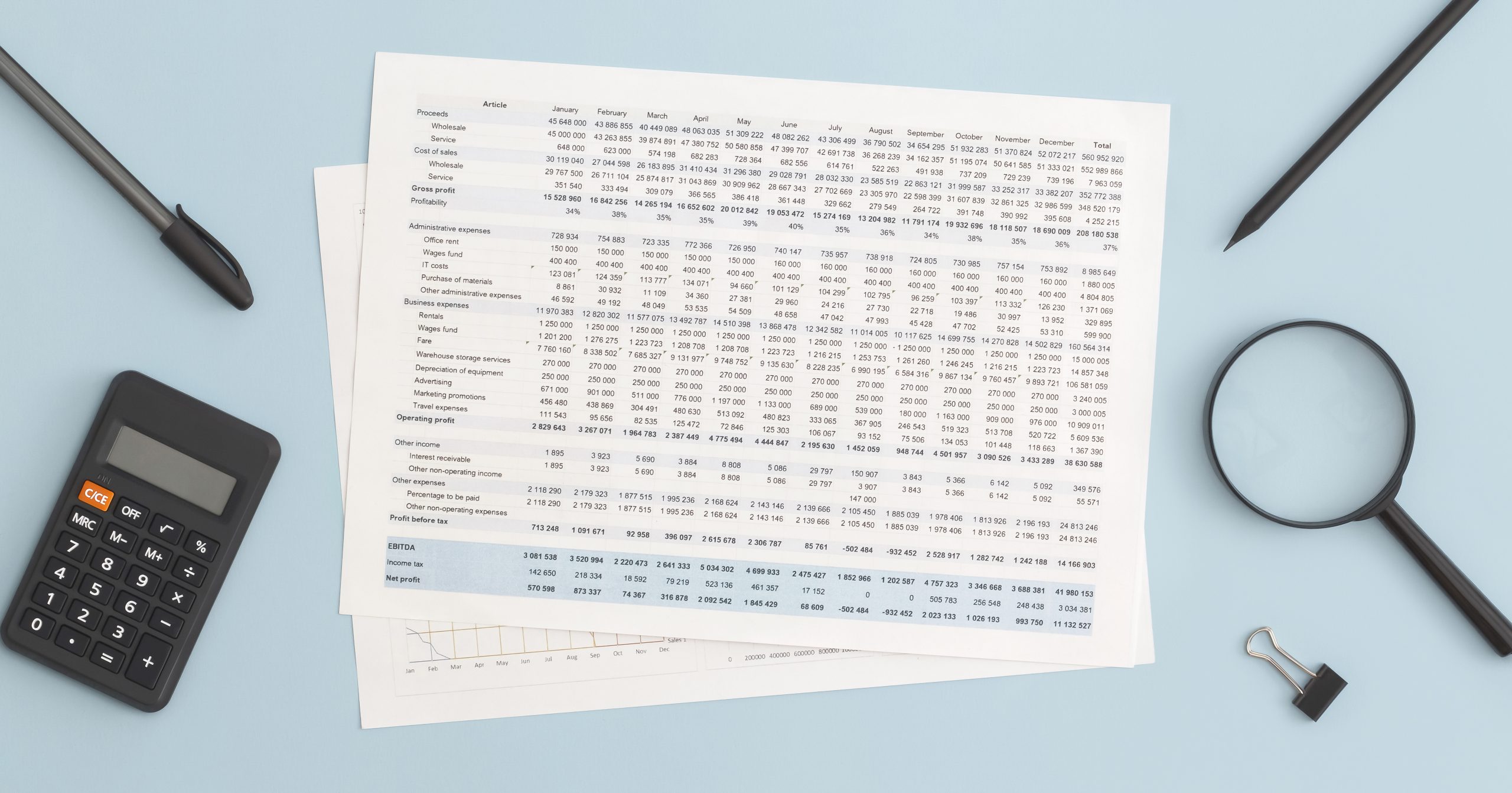

Management Accounts

Management Accounts It’s hard to run a successful business without management accounts. Although it’s not

Payroll/Auto Enrolment

Payroll/Auto Enrolment Processing payroll in-house can be time consuming and costly. Let us help you

R & D Tax Credit

R & D Tax Credit Is your company eligible for research and development tax relief?

Registered Office

Registered Office All companies in the UK must have a registered office address for correspondence

Seed Enterprise Investment (SEIS/EIS)

Seed Enterprise Investment (SEIS/EIS) Are you looking for investment in your startup or small business?

Self-Assessment

Self-Assessment We help with self-assessment so there will be no mistakes on your tax return.

Strategic Marketing

Strategic Marketing All you will ever need as a smart marketer. The importance of marketing

Tax Disputes

Tax Disputes From time to time, there will be disagreement between the taxpayer and HMRC.

Tax Investigation Protection

Tax Investigation Protection With the ever-increasing risks of entire tax enquiries and investigations, it’s worth

Tax Planning

Tax Planning We all have to pay our taxes but within the legal framework, there

Trusts

Trusts Trusts can be used as part of a wealth protection strategy to protect assets

VAT Returns

VAT Returns Deciding whether to register for VAT is key, particularly for business startups. You

Year End Accounts

Year End Accounts Year-end accounts often form the basis of your Self-Assessment tax return and